So.. what is Vmoto Ltd?

Vmoto Limited (VMT:ASX) is a global electric two-wheel vehicle brand owner, designer, manufacturer and distributor.

As more of the world begins to commit to lower carbon emissions and the future of net zero by 2050 the transport industry has become one of the central points for change. This is where VMT is aiming to step in as an electrified solution for the two wheeled enthusiasts.

VMT was incorporated in 2001 with a current market cap of around AU $100M it's definitely not knocking on the door of any top 100/200 indexes at the moment but it has shown significant growth in recent times.

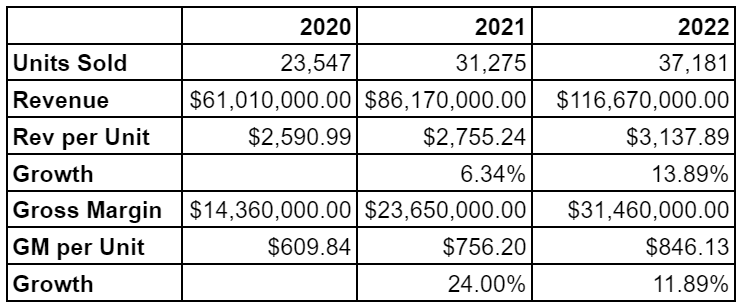

Revenue has compounded annually at 24% over the last three years and its operating margin has grown from 0.60% in 2019 to 7.6% in 2022. Units sold have also been increasing rapidly, in 2021 this grew by 33% and a further 19% in 2022. I’ll dive into the numbers a little further into the report but a bit more about the company now.

VMT head office is in Perth, Australia other than that most of the business is outside of the country with the manufacturing side of things well established in Nanjing, China.

VMT’s 30,000 sqm manufacturing facility is wholly owned by the company and was estimated per a 2021 presentation to have capacity to 10x the production volume of 23,547 units at the time. Having all manufacturing in China could be considered a risk. Given the willingness of the government in recent times to impose lockdowns in the country it may lead to disruption. Over the last 12 months the updates out of VMT assured investors that those most recent lockdowns in China did not impact the manufacturing facility in China and that it remained fully operational.

In February 2020 VMT entered into a deal with its strategic partner Super Soco to establish a jointly owned manufacturing company “Vmoto Soco”.

Vmoto Soco became the sole manufacturer for both Vmoto and Super Soco after Vmoto had previously sold Super Soco products alongside its own. As part of the deal VMT contributed $6.4M towards the venture and gained exclusive rights over sales and marketing of the Vmoto (E-Max) and Super Soco products on the international markets, but have forfeited those same rights domestically in China to Super Soco. The value of this investment is carried on the balance sheet under investments accounted for using the equity method.

There are a number of benefits VMT listed as part of getting this new agreement over the line including:

Streamlining of the supply chain processes

Increased production efficiency

Cost synergies and savings through reduction of manufacturing costs.

It does come with a layer of risk though given the need for Super Soco to cooperate with the agreement. This was emphasised back in December 2021 when VMT announced they had taken ‘certain legal actions’ in China to protect its rights and ensure Super Soco kept up its end of the deal.

VMT has operated in the electric two-wheel vehicle market since 2009 and considers itself a first mover in the industry.

There are a number of competitors in the industry and with a growing market and move towards more ‘green’ transport the risk of further competition and newer technology is real. Two of VMT’s competitors I will refer to within this report are Yadea Group Holdings Ltd. and NIU Technologies.

Yadea Group Holdings is listed on the Hong Kong stock exchange and is an investment holding company, researches, develops, manufactures, distributes, and sells electric two wheeled vehicles and related accessories in the People’s Republic of China.

The company offers electric scooters and electric bicycles; electric tricycle; and batteries and chargers, as well as other electric two-wheeled vehicles parts. It also provides management consultancy services. The company exports its products in approximately 80 countries. Compared to VMT it is a giant boasting a market cap of USD$7.5B.

90% of Yadea’s revenue was generated within China. So while it has a stranglehold on the Chinese market, VMT’s focus has been international, pointing to its large % of international sales as well as its deal with Super Soco to have exclusive sale and marketing rights outside of China.

NIU Technologies is the self proclaimed world’s leading provider of smart urban mobility solutions.

NIU designs, manufactures and sells high-performance electric motorcycles, scooters, bicycles and kick-scooters. NIU has a product portfolio consisting of ten series, four electric scooter series, including NQi, MQi, UQi and Gova, two urban commuter electric motorcycle series RQi and TQi, a hybrid motorcycles series YQi, a performance electric bicycle series, NIU Aero, and two micro-mobility series, the kick-scooter series, KQi, and the e-bike series, BQi. NIU is a little more comparable in size to VMT with a total market cap of USD$287M.

VMT serves both the business to customer (B2C) and business to business (B2B) markets with its primary brands broken down into:

VMOTO

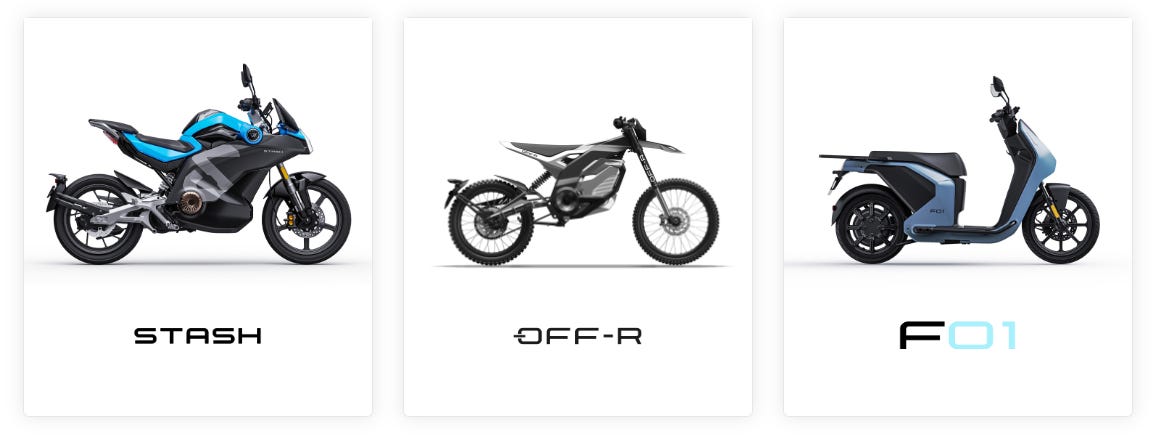

In recent years VMT launched its premium brand ‘VMOTO’ targeting the B2C markets.

The first VMOTO model launched was the ‘STASH’ which is European designed. Its electric motor has nominal power of 8 kW, and a peak of 15 kW when the boost function is available. Under normal driving conditions the Stash reaches a speed of 110 km/h, activation of the boost raises the limit to 120 km/h.

Recently VMT launched a range of dirt bikes under the VMOTO brand offering both an on road (“On-R”) and off road (“Off-R”) product. It again has an 8 kW engine with up to 150km per charge at an average speed of 30km/h and a charging time of 2-3 hours.

The final premium product VMT has introduced to the market is the F01.

The scooter is aimed at the general public commuting around the inner city streets. A little lower on the autonomy with a range of 80/90 km at an average speed of 45 km with the charging time also a longer 6 hours.

VMOTO Fleet

Vmoto Fleet targets the international B2B markets.

The brand has a number of different products including VS1, VS2, VS3, Concept F01. The primary target market for this segment of the business is the food and parcel delivery as well as ride sharing.

Between the four fleet options the motor power is between 2000W and 3500W.

The VS1 & VS3 have a greater load capacity for bigger deliveries and across all fleet options the max speed ranges from 45km/h to 80km/h. The tested autonomy ranges for the fleet are between 80km to 124km which I would assume would restrict some food/parcel delivery drivers as the need to charge could limit the amount of deliveries.

In a recent presentation it was noted that the fleet segment delivered a higher gross margin of between 25% - 35%, noting the most recent financials had the company gross margin at 27%.

Super Soco

Super Soco is a third party brand touched on a little earlier as Vmoto holds the exclusive marketing and distribution rights outside of China as it targets the International B2C markets.

Super Soco is described by the company as having ‘cool and fun’ technology products and aims to target customers with a ‘fun and trendy’ product. This kinda feels like your older uncle trying to keep up with a younger family member on TikTok?

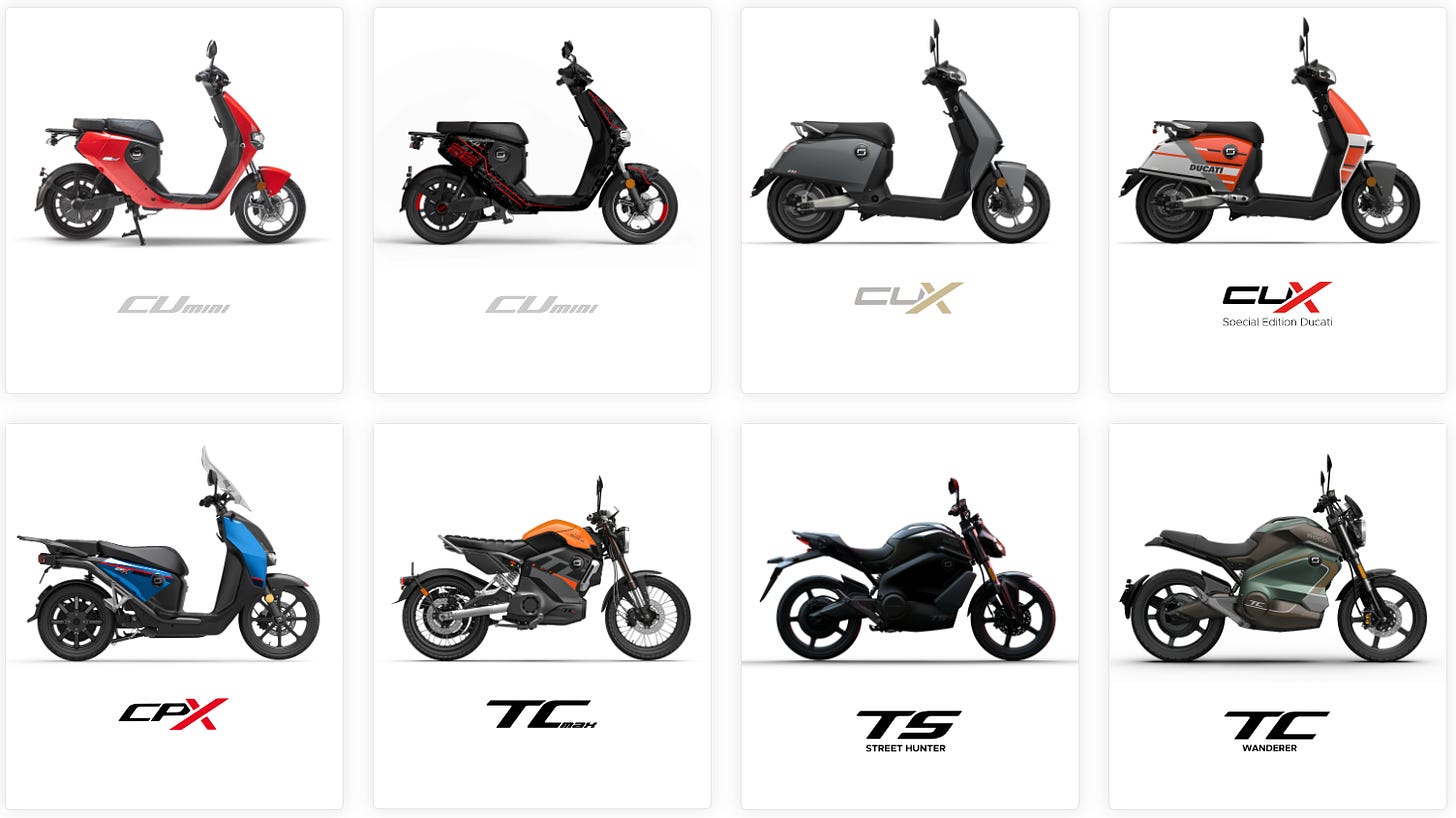

Super Soco has a range of scooters and bikes including a special edition ducati model.

Its CUmini and UX models are the scooter/moped style of vehicle and are lower and slower in power and distance compared to the premium VMOTO models. The TC & TS bike models offer a higher traveling speed and offer an alternative to the premium VMOTO product.

Okay.. How does VMT make money?

As mentioned above VMT utilises its lower cost manufacturing facility in China and leverages European design to sell electric motorcycles and mopeds predominantly outside of China.

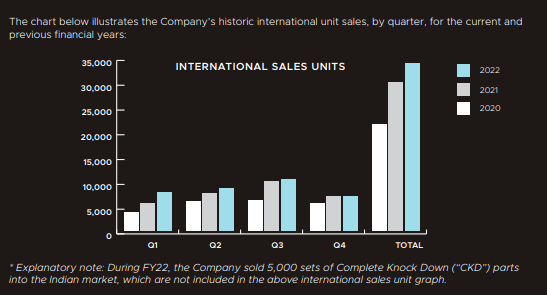

Of the total FY22 sales of 37,181 units, 33,687 of those were outside of China. In FY22 VMT noted it had continued to expand its B2C partnerships with 65 distributors world wide while boasting that it had a number of repeat orders from its B2B customers with additional orders expected.

One customer that won’t be repeating is GreenMo.

Greenmo was a market leader in the rental of electric bikes and mopeds to food and parcel delivery companies before declaring bankruptcy in early 2023. GreenMo had approximately 35,000 bikes and mopeds operating throughout Europe and was a B2B partner of Vmoto. While GreenMo did owe Vmoto around USD $2.7M in the end of FY22 there were no recent orders received from the business.

While the receivables outstanding aren’t hugely material it’s the loss of future business and orders that may hurt if a suitable replacement customer can not be found.

In 2021 Vmoto took its largest order from GreenMo of 5,904 worth around $13M to the business. Granted these aren’t recurring orders but the potential for future orders from what appeared to be a growing business expanding internationally may hurt.

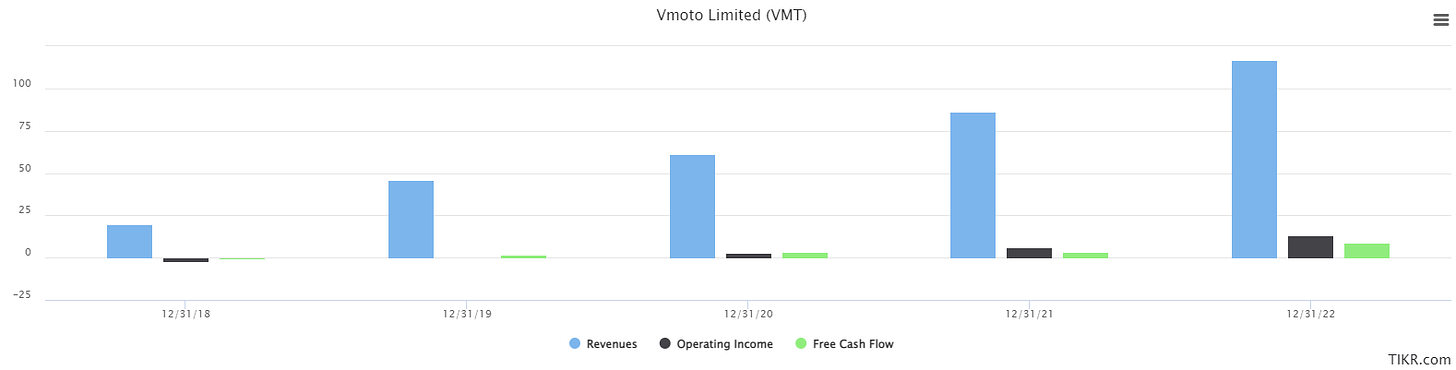

In recent times VMT has seen revenue skyrocket

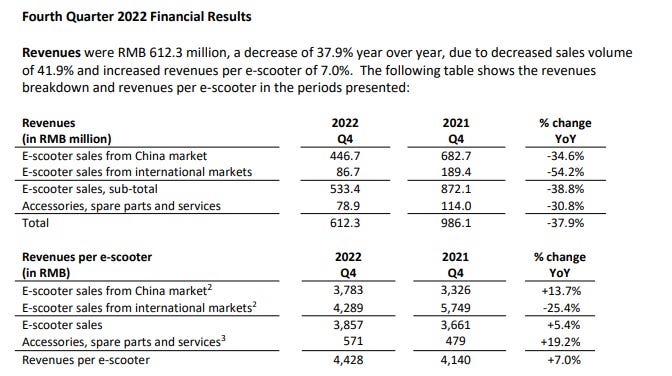

What has driven this growth? I read it as having an improvement in the product mix with greater efficiency and revenue per unit sold improving. If you look at the below table showing the last three years of unit sales, revenue growth and gross margin you can see the growth:

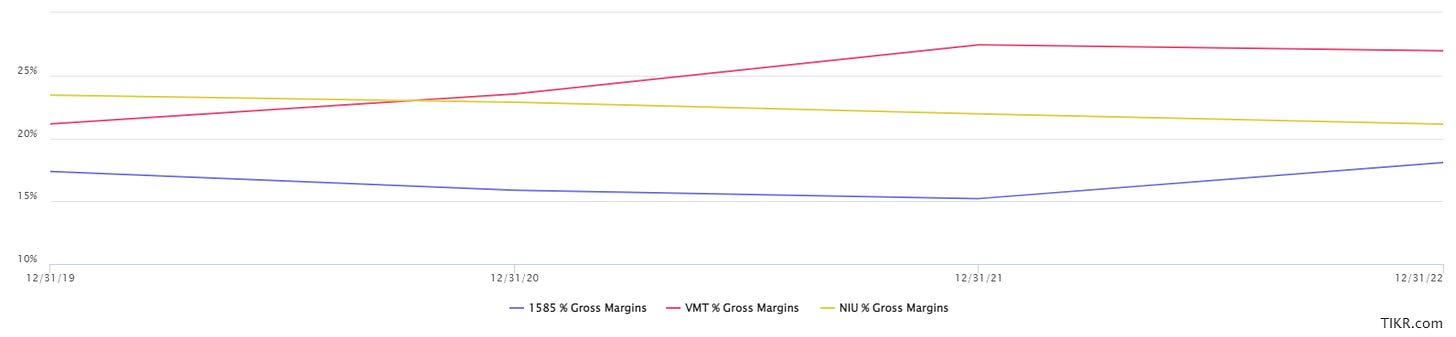

The potential higher margins on the premium products may only add to this going forward and will be a key item to watch. Overall Gross Margins compared to the NIU & Yadea Group below:

The above numbers do not include any complete knock down parts which are sold into the Indian market. VMT entered into a memorandum of understanding (MOU) with Bird Group back in March 2021 to deliver CUX and CUmini models from its Super Soco range. If the trial was satisfied the minimum order was to be 10,000 units. In the Q2 2022 market update it was announced that the MOU was ceased and it was instead progressing distribution with other Indian customers. In the most recent financials 5,000 knock down parts were sold into the Indian market which could be promising.

Compare this to competitor NIU and the VMT revenue per unit is far superior with the AUD equivalent (assuming fx rate of 1 RMB = $0.22) of $965 per unit compared to VMT’s $3,137. In saying that, NIU expects the sales volume for the full year 2023 to be in the range of 1 million to 1.2 million units…

While growing revenue is great it’s even better to be able to convert that into scalability and cash.

VMT has been steadily improving its operating income and margin. In 2019 the business was around breakeven and since then has expanded its operating income to $13M with an operating margin of 11.3%, growing at over 100% the last two financial years.

VMT has also managed to begin converting this into cash with the free cash flow margin as of 31 December 2022 at 7.4% and growing.

Who runs this thing?

Charles Chen is the managing director of VMT and is supported by Ivan Teo the finance director who have both been long term directors of the business.

Chen has been an Executive Director of the Company since 5 January 2007 and Managing Director since 1 September 2011. Chen has extensive experience in the motorcycle industry beginning his career with Hainan Sundiro Motorcycle Co Ltd which was the largest publicly listed company in Hainan Province where he held senior roles for 9 years. The company was eventually acquired by Honda Japan in 2001.

Chen then founded Freedomotor back in 2004 which was acquired by Vmoto, he remains in China, and oversees all of the Company’s operations and activities.

Teo joined the Company as Chief Financial Officer on 17 June 2009 and has been Finance Director of the Company since 29 January 2013. Teo is a qualified Chartered Accountant with around 20 years of experience in finance and accounting in both public and private companies.

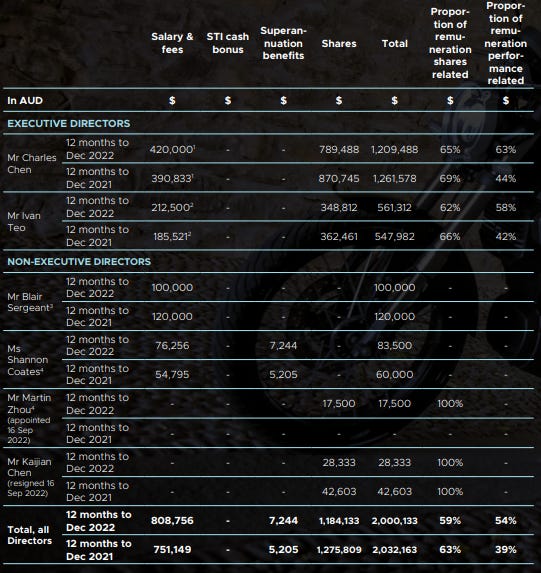

Stating the obvious here but how management remunerates themselves is always important!

VMT has established both a fixed remuneration package of the standard salary and wage as well as non cash benefits. These non cash benefits include the ‘Vmoto Limited Employee Long Term Incentive Plan’ which allows management to offer equity securities within the company to directors, employees and consultants to help retain high quality talent. The directors remuneration for the 12 months to 31 December is shown below:

59% of the total director remuneration is share related which:

In April 2022 VMT entered into a strategic advisory and investment agreement with European investors and executives Giovanni Castiglioni and Graziano Milone.

The idea behind this deal was to bring in two experienced campaigners within the motorcycle industry and enhance VMT’s sales, marketing and distribution.

The Castiglioni family has over thirty years of history in the motorcycle industry and has been involved in successful international brands including MV Augusta.

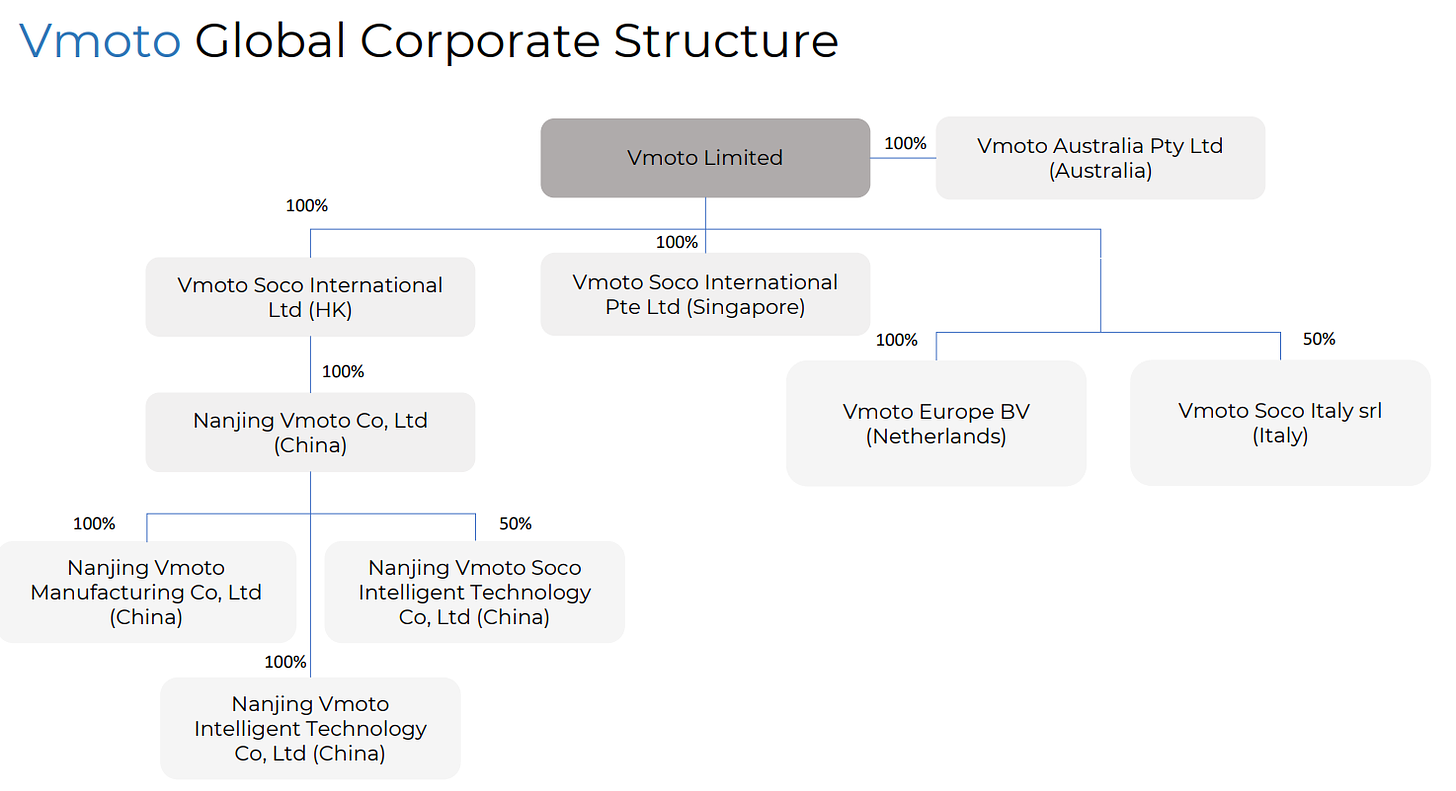

Milone was already a partner in VMT’s joint venture in its Italian distribution company, Vmoto Soco Italy srl (VSI) and was given a number of new titles which included the Company's Chief Marketing Officer / President of Strategy and Business Development. As part of the deal Castiglioni will also make an investment in VSI and as a result both Castiglioni and Milone each own 25% of VSI (together 50%), while Vmoto will retain a 50% interest in VSI. Group structure chart from the May 2022 presentation shown below:

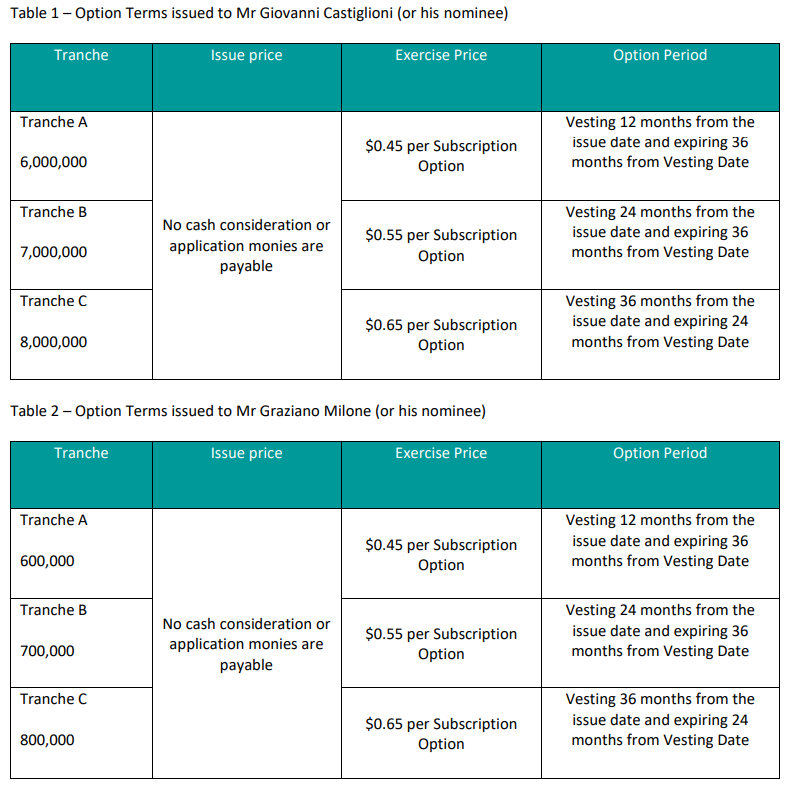

Furthermore, both Castiglioni and Milone will have a direct investment in VMT, subscribing to 1.2 million and 300,000 Vmoto Shares respectively as well as subscribing to 21 million and 2.1 million free attaching options respectively, that’s a big potential dilution! Details of vesting and price in the below table:

While there is some heavy dilution outlined above one thing you can’t deny is that the key personnel have skin in the game!

During the year ended 31 December 2022 increased his shares held from 23M to 36.6M which brought his total percentage owned in the business to 12.65%. Teo also owns around 3M shares and another key director Martin Zhou owns 7.11%. The top 20 holders of the business own 52.12%

Why would you think about owning VMT?

As discussed earlier in the report, what really catches your eye in recent times is the strong revenue growth of VMT while also generating growing profitability and cash flow.

Taking a look at the balance sheet I would consider it to be fairly strong with $28M in cash at 31 December 2022 and outside of lease liabilities there’s no debt.

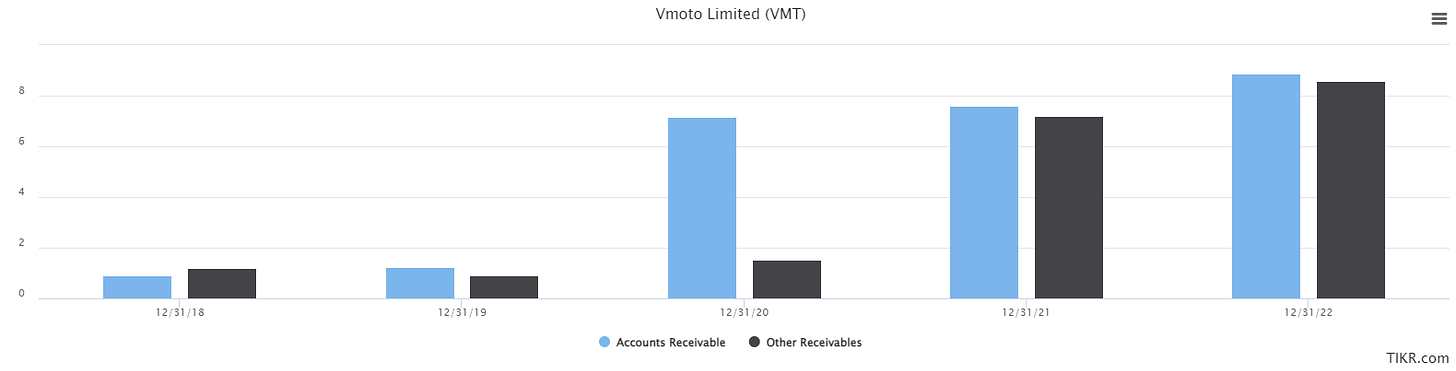

One thing to watch in recent years is the growing trade receivables balance, prepayments and inventory.

Both receivables and other receivables have both grown from around $1M in 2019 to both pushing $9M in 2022:

Of the $17.47M in total receivables $11,035,020 of those at 31 December 2022 were considered past due but not impaired (61 - 90 days $2.6M, +90 days $8.4M).

$4,828,095 relates to a deferred payment arrangement with a B2C customer of which VMT notes that the customer has been making payments on time in full. $5,515,369 of the balance relates to the related party Nanjing Vmoto Soco Intelligent Technology Co, Ltd (Vmoto Soco Manufacturing) in the form of a short term advance which won’t be due for repayment until August 2023. These feel isolated but given the write off of Greenmo as a result of its bankruptcy I’d be a lot more comfortable with seeing these balances reduced.

VMT’s inventory levels have been growing in recent years and if you bundle up the prepayments for the supply of inventory (which VMT has split in the financials) it increased by 43%.

I’d be hoping to see an increase in order numbers and sales throughout 2023 to work through these inventory levels. The go to metric for VMT is the upcoming firm international orders which as at 31 December 2022 was 8,046 to be manufactured and delivered in the first half of FY23. This compares to 12,488 at 31 December 2021 which the comparison is omitted from their 2022 report but the growth is shown in the 2021 report. Whether these numbers include the complete knock down units sold to the Indian market I’m not sure and perhaps this is a contribution toward the higher inventory held.

How is VMT sitting valuation wise?

Given VMT’s profitability and revenue growth you could make an argument that it is still making its way through its growth phase and still has time before maturing as a business. Regardless, the first metric I’ve looked at is the price to earnings (P/E) ratio on a trailing basis. Over the past three years the P/E has averaged around 24 which is heavily weighted to the earlier period. In more recent times that P/E has hovered around 10. This compares to Yadea Group which is around 33 for the 3 year period and 22 over the last 12 months. With its troubles in recent times NIU has gone negative.

The lower P/E compared to its competitors in the same industry may reflect the markets hesitation that the recent growth may not be sustainable?

So where does the future growth come from?

VMT is looking to move into growing markets. As mentioned earlier there was a deal to distribute products into India. India is the largest internal combustion engine two-wheeler market in the world.

In December 2022 VMT invested in Charged Asia, an electric motorcycle technology company in Indonesia focused on providing sustainable mobility options and Electric Vehicle as-a-service (“EVaaS”) to Indonesian customers.

EVaaS!? Everyone is trying to turn everything into a service and it appears Charged Asia is the same. Initially I thought, isn't this just leasing? Per the Charged Asia website

“Subscription is more to lifestyle that enable you with flexibility and customization during your subscription period. You will have the option to rides with different bikes after curtain period without being worry of your maintenance support, product reliability, nor hassles in asset management. While leasing will only provide you with single option of vehicle until the end of the lease period without flexibility.”

You can then own the vehicle after three years of subscribing.

Anyway, after that rant the Indonesian motorcycle industry is third in the world after only India and China. The Investment in Charged Asia provides a potential foot in the door of that market with a USD3 million (approximately A$4.5 million), per the VMT announcement the investment will be provided by way of credit offsets on batteries and electric vehicles supplied from Vmoto to Charged Asia or its subsidiaries over a 3-year period (Credit Period). In return, Vmoto will receive equity of 8% in Charged Asia, which currently has an investment valuation of USD38 million. Regardless of whether the available credit offsets are fully utilised during the Credit Period, upon the expiry of the Credit Period, the Subscription Price shall be deemed to have been satisfied in full by Vmoto. In addition, Vmoto will act as core technology partner of Charged Indonesia.

VMT also briefly mentioned in their most recent annual report that they are in discussions with a number of customers and partners in Brazil to assess whether it is feasible to set up local assembly facilities to reduce production costs and fast track growth in the country.

Furthermore they have appointed a distributor in the USA with the expectation that this will increase orders in the coming financial year.

Overall I believe the electric transport industry has huge tailwinds that VMT can benefit from assuming it can continue its growth. There are a few things I would like to see improve such as orders increasing at the same rate as the level inventory and prepayments. As with any spec share there’s going to be risks, it’s definitely going to be an interesting watch and a bit of a unique business on the ASX for sure.

If you’re still reading at this point I appreciate you! If you have any suggestions, critiques or guidance on what could be done better on the above I would greatly appreciate it. The above is all for research purposes only and shouldn’t be taken as advice!

Gracias!

Just finished reading; quality write up! Thanks for sharing. When I first started looking at them 4 years ago, they were priced for growth, and now with $68M in assets on the balance sheet, a market cap of $100M, and producing ~$10M in profits, they are eventually going to become a deep value play.

I heard the Blair Sergeant comment on order numbers numerous times in the past; short summary is; it's always going to be lumpy. A B2B customer can put in a massive order, and then nothing for a few years. So yeah, will see...

On the lower P/E, I think the recent drama you mention with GreenMo and the overall hesitation for small caps is keeping this one in obscurity for now. If growth continues, I suspect this will change eventually.

Well done once again mate.

I would say the one bit of analysis you're missing is around capital allocation. I think that's a big hesitation in the market right now. They have a third of their entire market cap in cash with no debt but haven't really maid any major capital allocation decisions (besides a few small acquisitions). What they decide to do with that cash is going to have a huge impact on the stock price. They've seemingly only been earing around 1.5% interest on the cash as well. I feel like a major CA decision would see a big reaction from the market. Though I also worry that they're being way overly conservative.