Austco Healthcare Delivers a Disappointing First Half

The provider of healthcare communication and clinical workflow solutions Austco Healthcare reported their first half earnings report on Monday

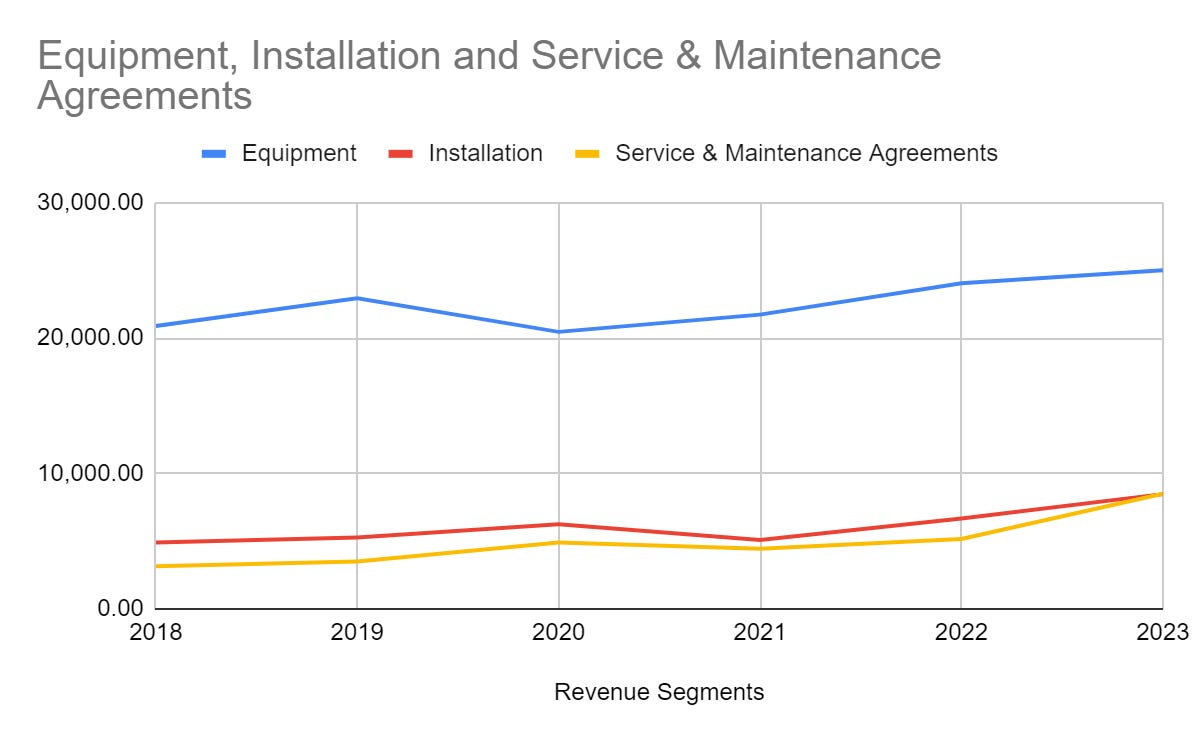

Revenue ‘surged’ (their words not mine) 11% to $22.8 million with higher margin software and service and maintenance agreements (SMA) also increasing 11% and making up 17% of total revenue, down from 20% in FY23. While software and SMA was up on the prior period it dropped to $4 million from $4.9 million compared to the second half of FY23. The increase in revenue included ‘slightly more than one month’s revenues from newly acquired Teknocorp’.

Following a decent run into results the share price was punished, closing the day down 9.09% at $0.20.

Declining Gross Margins

Austco’s gross margin dropped to 51.9% in the first half, down from 54.8% compared to December 2022.

It was a further decline from the 52.2% gross margin in the second half of FY23. The higher cost of raw materials wreaking havoc. The company had been willing to pay a higher price for materials to ensure certainty of delivery which is expected to be consumed in the second half of FY24. Previously, continued growth in software and SMA revenue offset these supply issues and supported the margin. With this lower in the first half as a portion of overall revenue the gross margin has been put under pressure.

The jewel in the crown of software and SMA has been the growth seen in the US.

Despite software and SMA growing by 11%, the US segment declined when compared to the prior period, dropping 20%. On the positive it meant that there was significant growth in other markets.

The company also noted that a higher contribution from lower margin markets in Latin America and Asia as well as the Teknocorp projects contributed towards the decline.

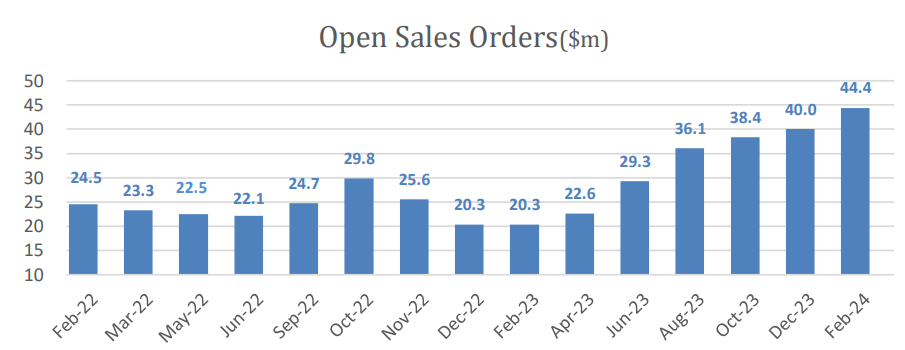

Open sales orders

The open sales order book continued to grow.

As of February 2024 the $44.4 million in confirmed contracted orders yet to be recognised as revenue, $3.3 million related to the acquisition of Teknocorp. The book has more than doubled from 20.3 million 12 months earlier, as a shareholder I am hoping to see a greater revenue growth given the large increase.

Profitability & Financial Position

Disappointingly, net profit after tax was down to $1.2 million for 1HFY24 compared to $1.4million in 1HFY23.

The previously mentioned decline in gross margin as well as increased depreciation and amortisation, travel and merger & acquisitions (M&A) costs were the main culprits. On a positive note, employee expenses remained flat showing signs of less wage pressures and the company mentioned that they do not expect additional cost growth outside of M&A.

The combination of falling earnings and increasing share count as part of the acquisition led to a decrease in earnings per share.

With the Teknocorp acquisition contributing for an additional 6 months I’d expect earnings per share to improve in the second half.

At the end of December Austco had cash on hand of just under $5 million, relatively unchanged when compared to the 30 June 2023 balance.

The cash balance was supported by proceeds from a new debt facility to fund the Teknocorp business of $1.6 million. As at 31 December 2023 the balance owing stood at $1.544 million. Austco has continued to maintain high inventory levels providing cover for the increasing open sales orders as well as stock brought across via acquisition. Favourable working capital movements led to an improved operating cash flow result with a 55% increase to $1.8 million.

While a disappointing result I’m willing to keep faith in Austco for a little while longer and will be keeping an eye on the order book to revenue conversion going forward. With acquisitions front of mind shareholders are required to put a lot of faith in management that the capital allocation and expansion into the Australian market works while returning to growth in the US market.

Don’t know anything about Austco?

Communication serves as a literal lifeline connecting caregivers with their patients in moments of vulnerability. Austco Healthcare is a global provider of nurse call systems, enterprise reporting and analytics tools empowering clinical professionals to excel.

What are their products?

The business can be split into two primary solutions:

Nurse Call Solutions

Tacera stands as Austco's premier nurse call system. Its platform offers an array of features including pendants, pillow speakers, call points, pull cords, annunciators, lights, touchscreen stations and audio devices. Austco has an additional nurse call product Medicom. Medicom is a simpler, more cost effective solution.

Alarm Management & Reporting Analytics

Austco manages both alarms and reporting analytics through Pulse.

Pulse Mobile is a smartphone app allowing nurses to manage alarms and control the nurse call system. This gives nurses the ability to manage call functions and workflows remotely.

Pulse reports is a reporting analytics platform. The platform allows staff access to the nationwide health system with the ability to run custom automated reports. From the one interface healthcare staff can communicate between departments while measuring performance against protocols.

Transformation in Revenue and Margins

Historically, the majority of Austco’s revenue has been lumpy one off contracts with hospitals. Typically, these contracts are won during the construction phase of the hospitals like its record largest contract with St. Paul’s Hospital in Vancouver, British Columbia.

Austco has made no secret of their strategy to incorporate higher margin software and service and maintenance agreements (SMA).

Following the pandemic, the company has witnessed a revival in software sales with the ability to get back in a room with the customer. The strong take up has seen software and SMA revenues increasing by 65% in the 2023 financial year. Prior to the dip in the first half of 2024 the segment had made up 20.2% of revenue and has ramped up over the last few years. North America in particular has been a particularly successful hunting ground with Software/SMA revenue growing by more than 100% in FY23.

Management are confident that the demand for the higher margin segment is here to stay as customers are seeing the value of the support and software upgrades over the life of their product deployment.

Despite the large increase in software and SMA segment sales, gross margin has seen moderate growth.

As mentioned in the half year results the availability and cost of raw materials created chaos throughout Covid-19. Austco was not immune to supply chain issues. Gross margin in 2023 increased from 52.5% to 53.4% before declining in the first half of 2024. Once the more expensive stock is off the books shareholders will be hoping Austco can begin to see a return to higher gross margins. Austco will be looking to further gross margin growth support from the equipment and installation segments alongside the growing software and SMA division. While these areas of the business are growing, they haven’t been improving as quickly as software and SMA.

What has been growing is the sales order book.

As discussed above Austco’s open sales orders hit a record of $44.4 million as of February 2024.

The open sales represent orders from customers that are yet to be fulfilled and have not been recognised as revenue in the accounts. Throughout the pandemic Austco faced site restriction difficulties which impacted the delivery of its products. As a result you can see the significant build up of the orders during that period.

This provided both a challenge in converting sales into revenue while also putting a strain on working capital. As a result inventory balances have more than doubled in the last two years to support orders whilst also getting ahead of any potential disruptions to supply.

Austco Doesn't Come Without Some Baggage.

Austco Healthcare is the third name change since listing on the ASX following on from TSV Holdings (2012) and Azure Healthcare (2020). Robert Grey established the business in 1986 before floating in 2006 While he remains a significant shareholder his time at the helm ended abruptly on the back of earnings downgrades in November 2014 and June 2015.

The below two year period isn’t the pandemic. It's a rollercoaster 24 months where the company share price ran up 433%.

Growing revenue and profitability led the share price higher before crashing back to earth as the growth tailed off.

Clayton Astles took over as CEO in July 2015 following Grey’s departure.

Prior to his new role Astles had worked within the business as president of the company’s main operating subsidiary. Astles played a lead role in building the reputation as a leader in the nurse call and clinical software solutions market in the United States. Based in Dallas, Astles was a significant influence in the establishment of a software development centre and manufacturing facility.

Since this time the key management personnel have been relatively stable. Astles, Graeme Billings and James Burns having all been part of the team since 2015

Acquisitions, Recent Contracts and A Competitors Exit

Teknocorp acquisition.

In late September Austco announced it had executed the acquisition of hardware and software solutions provider Teknocorp.

Teknocorp is well known to Austco as a certified reseller and provides an opportunity to further grow its Australian market share. The aim of the acquisition is to replicate the direct sales success seen in North America and Singapore.

CEO Clayton Astles commented:

“We are thrilled to announce the successful acquisition of Teknocorp, which marks another step in Austco’s continued growth and commitment to delivering exceptional value to our customers. I want to extend my gratitude to our dedicated employees, partners, and stakeholders who have contributed to the success of this acquisition. We are excited about the possibilities ahead and are confident that this strategic move will strengthen our position in the market and enable us to be[er serve our customers.”

At the time of the initial announcement Teknocorp was forecast to achieve approximately $9 million in revenue and $1.1 million in earnings before interest depreciation and amortisation (EBITDA). The price? A combination of cash, shares and a potential earn out on 31 December 2024 numbers. The final figure is estimated to be $3.85 million or 3.5 times EBITDA.

Just last week Austco announced its intention to acquire Amentco, another healthcare solutions provider and Certified Austco Nurse Call reseller.

Again, the reasoning behind the acquisition is to accelerate its growth into the Australian market. Consistent with the Teknocorp acquisition, Austco will pay 3.5 times EBITDA.

Recent contracts.

Austco has been awarded a number of significant contracts in the last 6 months including the largest in its history.

As mentioned earlier the $7.4 million contract is for a new 548-bed St. Paul's Hospital in Vancouver, British Columbia. Austco will supply the hospital due to be built by 2026 with its Tacera alarm management and clinical workflow solution.

Further to this deal, in May the company signed a $3.9 million deal to supply the Tacera platform and comprehensive low-voltage solution to a new 192 bed aged-care facility in Athens, Ontario.

The expectation was that part of these contracts revenue would be recognised in the 2023 financial year.

Over the Hills

An Australian competitor of Austco, Hills Limited (ASX: HIL) recently went into administration following a difficult period of losses, supply chain issues and hampered with debt.

In a highly competitive industry having one less player does provide a boost to Austco. Hills had reported in their half year accounts that as of 31 December 2022 the company had accumulated over $17.6 million of future orders, predominantly for delivery in FY24 and FY25. I believe this would have included the tender won in September 2022 for the new Footscray Hospital due to be completed in late 2025. The nurse call contract was expected to be worth $7 million and included a further option to continue in the hospital operating phase following completion.

Perhaps this and other contracts may be up for grabs for Austco but also a warning sign that order books aren’t everything.

Outlook & Valuation

If Austco can continue to work through its open order book and look to convert these to sales we could see a significant jump in revenue for FY24, despite a disappointing first half.

If the company repeats a similar second half earnings per share figure it would generate 0.689 cents per share. At current prices it would be trading on a multiple of 29 which seems excessive for a company growing at 11%. Granted I believe this would be conservative given I expect Teknocorp earnings to provide a boost in the second half and hopefully recognising further revenue from the expanding order book.

We could of course see costs grow further as the business looks to expand its marketing and R&D so perhaps this may be skewing the calculation. Growth for Austco is also dependent on continuing to win new contracts as new hospitals are built which is something to track. Like any valuation estimate it’s never going to be perfect!

While the first half lacked inspiration and the thesis is tested, with record contracts being signed and supply chain issues alleviating, I believe Austco Healthcare could still be well positioned to continue its recent strong share price growth.

If you’re still here, thanks for reading, I appreciate it! Would love any feedback particularly on this format or any additional thoughts/critiques. As always the above isn’t advice and for research purposes only! I currently do hold a position in Austco.